2026 California Employment Law Updates

Below is a summary of the 2026 most significant developments every California employer should be aware of, as well as a few key vetoes that provide some relief for employers.

KEY NEW EMPLOYMENT LAW UPDATES

1. California Minimum Wage (Labor Code § 1182.12)

Starting January 1, 2026, the statewide minimum wage will increase for all private employers to $16.90 per hour, regardless of business size. This change impacts exempt employee classifications, wage-related premiums, sick leave accruals, and even wage statement compliance. For example, this wage increase will affect premium pay calculations for split shifts, reporting time, and meal/rest period violations.

With this new minimum wage, exempt employee minimum salary threshold will be $70,304 per year or $5,858.67 per month.

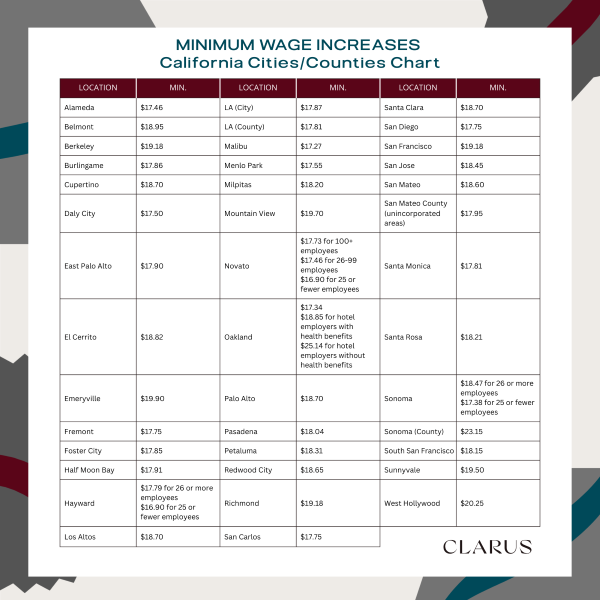

Local ordinances may still impose higher minimum wage rates. Click here to download a reference guide with all local minimum wage increases that surpass the state rate.

Takeaway: Conduct audits of employee compensation, update payroll systems, revise policies and workplace postings, train HR and payroll personnel, and monitor additional developments.

2. Updated Notice for Victims of Crime (AB 2499)

The bill expands the definition of “victim” to include not only individuals directly subjected to domestic violence, sexual assault, or stalking, but also those who have experienced other qualifying crimes or abuse, including serious bodily injury, threat of injury or death, and crimes resulting in the death of a family member.

Takeaway: All employers must provide employees with written notice of their rights under this statute.

3. Paid Family Leave Expansion (SB 590)

Starting July 1, 2028, Paid Family Leave (“PFL”) benefits will extend to care for a “designated person,” defined broadly as anyone the employee considers family.

Takeaway: Start planning for policy and handbook updates now to reflect future PFL coverage expansion.

4. “Workplace Know Your Rights” Act (SB 294)

By February 1, 2026, employers must give all employees an annual written notice explaining their rights regarding immigration-related practices and interactions with law enforcement. You’ll also need to let employees name an emergency contact if they’re detained or arrested at work no later than March 30, 2026 (or at the time of hire for employees hired after that date).

Takeaway: Monitor for the Labor Commissioner’s template notice (expected by January 1, 2026) and integrate this communication into onboarding and annual compliance cycles.

5. Ban on “Stay-or-Pay” Provisions (AB 692)

As of January 1, 2026, new restrictions will prohibit training repayment agreement provisions (“TRAPs”) and other stay-or-pay contracts designed to penalize employees for resigning. Certain tuition reimbursement and retention bonus programs remain permissible within statutory limits.

Takeaway: Audit offer letters, repayment agreements, and retention programs to ensure continued compliance.

6. Revised Pay Transparency and Equal Pay Act (SB 642)

The definition of “pay scale” is clarified as a good faith estimate of the expected salary or hourly range upon hire. The Equal Pay Act also extends its statute of limitations and allows wage recovery going back six years.

Takeaway: Review job postings, pay audits, and recordkeeping practices to manage extended exposure.

7. Personnel Records Requests (SB 513)

Starting January 1, 2026, education and training records are explicitly part of the “personnel records” that current and former employees (or their authorized representatives) have the right to inspect and copy under Labor Code section 1198.5. Training records must show the employee’s name, trainer’s name, date and duration of training, core competencies of training (incl. skills in equipment or software), and any resulting certification or qualification.

The same 30-day rule remains, allowing employers to respond to written requests for inspection or copies within 30 calendar days, unless both parties agree in writing to extend up to 35 days from the date the employer’s receipt of the written request. Similarly, the same retention period of at least 3 years after an employee’s termination remains.

Takeaway: Ensure compliance with SB 513 by retaining all education and training records in each employee’s personnel file.

8. Extended Statute of Limitations for Sexual Assault Claims (AB 250)

This bill creates a temporary window for adult survivors of sexual assault to file civil lawsuits that were previously time-barred by the statute of limitations. The law targets cases involving institutional "cover-ups" and applies to private entities, but not public entities.

Takeaway: The law creates a two-year "revival window" from January 1, 2026, to December 31, 2027. During this period, survivors can bring claims that would otherwise have expired under the standard statute of limitations.

9. AB 5 Exemption Extensions (AB 1514)

This bill extends the exemptions from the AB 5 “ABC” worker classification test for licensed manicurists until January 1, 2029, and commercial fishers until January 1, 2031.

Takeaway: Licensed manicurists and commercial fishers will continue to be evaluated under the more flexible Borello test.

10. Mandatory Penalties for Pay Data Reporting (SB 464)

Beginning January 1, 2026, courts must impose penalties for failures to comply with pay data reporting requirements upon request of the Civil Rights Department. Job categories expand from 10 to 23 by 2027.

Takeaway: Strengthen pay reporting processes now, as enforcement discretion will no longer be available.

11. Cal-WARN Notice Changes (SB 617)

Starting January 1, 2026, notices required under Cal-WARN must indicate whether the employer plans to coordinate services through the local workforce development board or another entity. If so, the employer must arrange for those services within 30 days from the date of the written notice.

Takeaway: Review and update template notices before implementing workforce reductions.

12. Wage Theft Claims for Tips and Gratuities (SB 648)

Effective January 1, 2026, the Labor Commissioner may investigate, issue citations, and bring civil actions when employers unlawfully take or withhold any money owed to employees, including gratuities. Until now, the Labor Commissioner could investigate wage theft, but its enforcement authority with respect to tips was limited. SB 648 closes that gap.

Takeaway: Employers in the hospitality, food service, and other tipped sectors are encouraged to review their tip pooling, distribution, and recordkeeping practices.

13. AI Transparency and Whistleblower Protections (SB 53)

California enacted the nation’s first comprehensive Transparency in Frontier Artificial Intelligence Act, imposing reporting and safety obligations on developers of advanced AI systems. While primarily directed at technology companies, the law introduces new whistleblower protections and may indirectly affect any employer using high-level AI tools in employment or operations.

Takeaway: Review internal AI and data use policies now to confirm compliance frameworks are adaptable once state guidance issues.

14. 30-Day Data Breach Notification Rule (SB 446)

Employers must notify individuals of a data breach within 30 days — a much tighter timeline that may kick in before an investigation is finished.

Takeaway: Make sure your IT, HR, and legal departments have a response plan ready that meets the new statutory timeframe.

15. State Jurisdiction Over Labor Disputes (AB 288)

Starting in 2026, the California Public Employment Relations Board (“PERB”) will have authority to decide unfair labor practice cases in the private sector when the charge or petition is brought by a worker who (1) is employed in a position covered by the National Labor Relations Act (“NLRA”) and (2) loses coverage under the NLRA because the federal law is repealed or narrowed, or because the National Labor Relations Board has ceded jurisdiction to states. The NLRB has already challenged the law in federal court.

Takeaway: While enforcement is uncertain, stay alert to the outcome of this litigation, particularly for multi-state employers who rely on consistent NLRA preemption.

16. Pandemic-Related Hospitality Recall Rights Extended (AB 858)

COVID-era recall rights for laid-off hospitality employees are extended to January 1, 2027.

Takeaway: Continue maintaining recall records and processes for hospitality operations.

17. Child Abuse Prevention Procedures to Private Schools (SB 848)

Starting in July 2026, private and religious education institutions will have to comply with abuse prevention procedures that already apply to public schools, including developing school safety policy, mandated reporter trainings, and certain personnel vetting procedures.

Takeaway: Ensure compliance with SB 848 by familiarizing yourself with available abuse prevention information and resources before drafting new safety policies, compile a list of individuals who would be required to attend mandated reporter trainings, revise interviewing and hiring guidelines, and update employee handbook policies.

18. Enhanced Wage Judgment Enforcement (SB 261)

Employers with unsatisfied wage judgments face triple penalties, mandatory attorneys’ fees, and enhanced enforcement powers for the Labor Commissioner.

Takeaway: Prioritize prompt resolution of wage claims to avoid escalating liability.

KEY VETOES WORTH NOTING

1. “No Robo Bosses” (SB 7)

This bill would have heavily restricted AI use in employment decisions. Governor Newsom vetoed this bill as overbroad, duplicative, and potentially harmful to California businesses.

2. Immigration Enforcement Leave (AB 1136)

This bill would have provided workers with up to 5 days of unpaid leave for immigration matters and reinstatement rights (for up to 2 years) for employees who have been terminated due to lack of proper work authorization but consequently produce it. Governor Newsom vetoed this bill as potentially confusing and burdensome.

3. “Right to a Health Mask” (AB 1326)

This bill would have given individuals the right to wear health masks at work and other “public settings.” Governor Newsom vetoed this bill because existing law “appears sufficient to allow a person to wear a mask for health reasons in most public situations,” and because a sweeping policy with numerous exceptions could have created confusion.

BILL ON STANDBY

1. Captive Audience Meetings (SB 399)

SB 399 went into effect January 1, 2025, barring employers from requiring staff to attend “employer-sponsored” meetings or to “participate in, receive, or listen” to any employer communications regarding “religious or political matters.” On September 30, 2025, the Eastern District of California issued its opinion findings that state-level restrictions on captive audience meetings are preempted by federal labor law and violate the First Amendment.

Takeaway: Employers have more breathing room when requiring staff to attend meetings regarding their position on unionization efforts, commonly referred to as “captive audience” meetings.

Clarus is ready to work with you to develop compliance checklists, revised policy templates, and workforce communication strategies. Whether it's a customized briefing or workplace audit, we're here to ensure you're in compliance with these legal updates.